Strengthen your portfolio with unique HIGH YIELD FIXED INCOME opportunities.

Starting at $100,000 USD/EUR/GBP

10%pa

12 months

Starting at $500,000 USD/EUR/GBP

12%pa

12 months

Starting at $1,000,000 USD/EUR/GBP

13%pa

12 months

11%pa

24 months

14%pa

24 months

15%pa

24 months

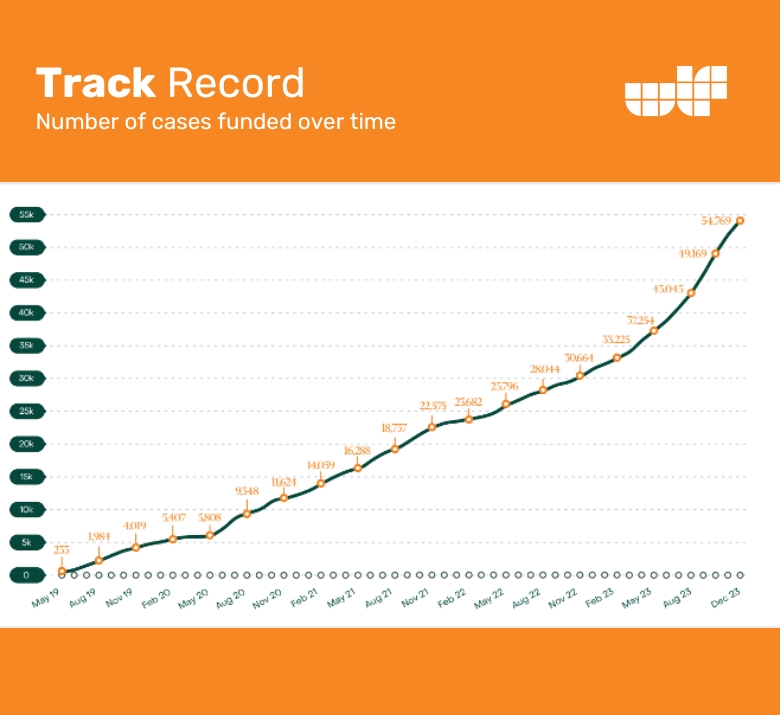

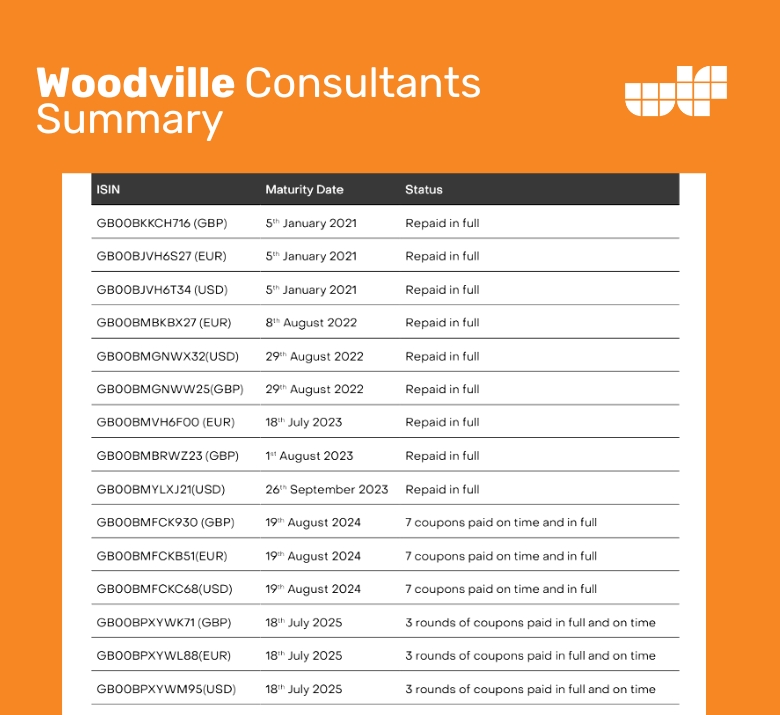

Woodville Consultants Ltd, a UK funder, specialises in providing funding to SRA-regulated law firms for very specific litigation cases in the UK. Each funding provided is protected by the After The Event (ATE) insurance.

Talisman Surety & Fidelity issues the protection policy and is reinsured by Lloyds of London (Rated A by AMBest)

Senior Secured and Asset Backed via Security Trustee

Corporate Presentation July 2025

Corporate Presentation July 2025